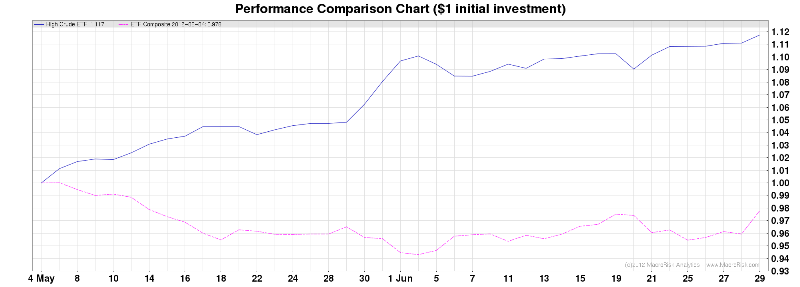

Optimized ETF Portfolios—Global OilIn general, the optimized ETF portfolios may be regarded as representative of a "forward-looking" perspective of six months out, timed from events that trigger each respective scenario.The "Composite Portfolio" is composed of approximately 1,000 ETFs that constitute an internally generated "buy list." It is equally weighted as of the start of the performance period. Updated: July, 2012 Source: MacroRisk Analytics |

Global Oil: Home Global Oil: Comparing Scenarios Global Oil: Optimized S&P 1500 Global Oil: Correlations of Returns and Values QuickResponse™ Portfolios InterActive: Home |

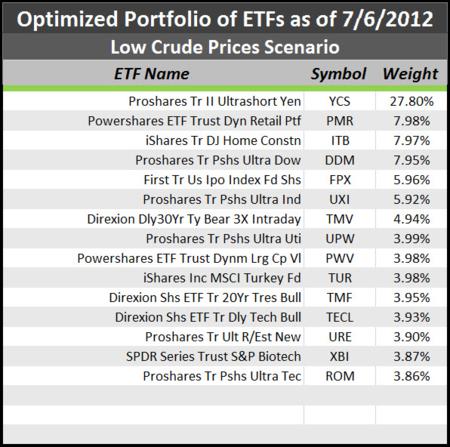

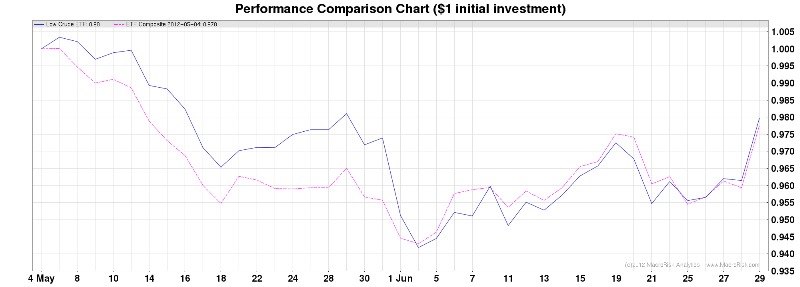

| LOW CRUDE OIL PRICES | |

|

Optimized ETF Portfolio Optimized ETF Portfolio

ETF Composite Portfolio ETF Composite Portfolio |

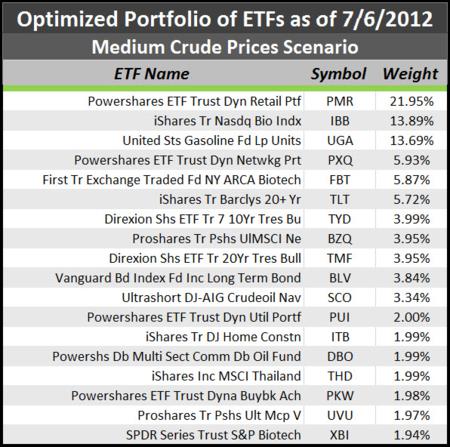

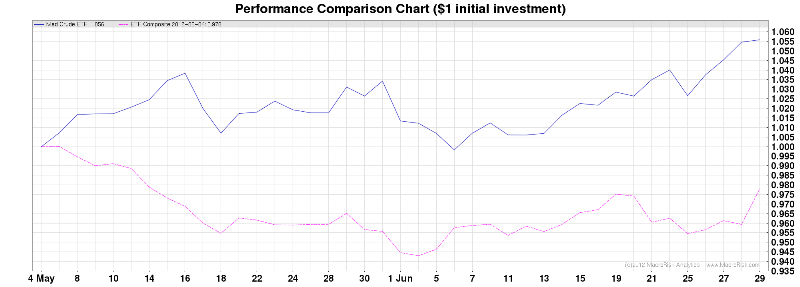

| MEDIUM CRUDE OIL PRICES | |

|

Optimized ETF Portfolio Optimized ETF Portfolio

ETF Composite Portfolio ETF Composite Portfolio |

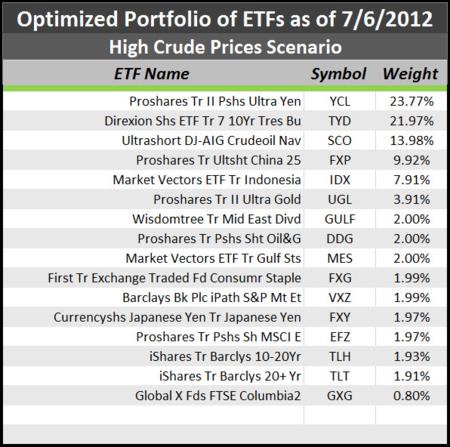

| HIGH CRUDE OIL PRICES | |

|

Optimized ETF Portfolio Optimized ETF Portfolio

ETF Composite Portfolio ETF Composite Portfolio |

| Disclaimer Contact Us Privacy Policy Terms of Use | |

|

Copyright © 2015 Sabrient Systems, LLC. All rights reserved.

|